Suburbtrends Top 10 Blue‑Chip Family Areas in Australia (2025)

Summary

Australia’s blue‑chip family belt clusters around suburbs with high owner‑occupier depth, strong school corridors and everyday amenity that reduces reliance on the CBD. Across our Top 10 SA3s (Statistical Area Level 3), the median asking price spans $1.10m–$3.50m, with an average distance of ~16 kilometres from the city core. On the demographics that matter for stability, these areas average ~79–80% family households, ~81% detached housing, and ~40% fully owned dwellings, alongside a high Socio Economic (SEIFA) profile of ~9/10. In short: these are places where families settle, schools anchor demand and tenure patterns cushion the cycle.

Geographically, the list is balanced: Sydney (Ku‑ring‑gai; Dural–Wisemans Ferry; Sutherland – Menai - Heathcote) , Melbourne (Bayside; Manningham – East; Nillumbik Kinglake) , Adelaide (Burnside; Mitcham) and Brisbane (Kenmore–Brookfield – Moggill; Centenary). Each combines family‑weighted demographics with rail or motorway access and a slate of parks, beaches/rivers and village retail. Suburbtrends’ Area Hotlist signals—drawn from thousands of listing mentions—corroborate what households value most: elite public and independent schools, reliable commute options, and proximate green‑space.

Introduction

This Top 10 identifies Australia’s blue‑chip family areas using Suburbtrends measures provided for each SA3: family household share, detached‑house share, fully‑owned tenure, Family Rating, distance to the city and Socio Economic score, paired with median asking price (12 months). The rankings also reference each area’s Area Hotlist—a behavioural lens on the amenities buyers repeatedly name in listings (schools, stations, beaches/rivers, parks and shopping villages).

Three themes unite the winners. First, schooling depth: access to high‑performing public catchments and premium independents consistently lifts willingness‑to‑pay and underpins resale resilience. Second, transport pragmatism: rail nodes, Metro/freeway links and park‑and‑ride facilities shorten commutes and keep dual‑income households sticky to place. Third, lifestyle utility: coastlines, rivers, national parks and large reserves deliver daily wellbeing dividends, while village retail concentrates convenience without sacrificing neighbourhood character.

For buyers, the playbook is simple: prioritise catchment lines, walkable access to stations or retail villages, and streets with clear owner‑occupier continuity. Across cycles, these factors—evident in the data for every suburb in this list—are the hallmarks of suburbs that hold their value and remain in perennial demand with Australian families.

Ku‑ring‑gai (NSW)

Eleven kilometres north of the CBD, Ku‑ring‑gai (SA3) anchors the Upper North Shore with classical family credentials and deep amenity. The median asking price is $3,500,000 (12 months), reflecting a market led by families (81.8% of households) and detached living (68.7% of stock). A Family Rating of 5/5, Socio Economic score of 10 (very high) and 40.2% fully owned homes point to an entrenched owner‑occupier base—typically a stabiliser through cycles and a signal of long‑run value preservation.

The Suburbtrends Area Hotlist quantifies what households value here. Education is the anchor: Killara High School (1,390 mentions) and St Ives High are consistently targeted for catchment security, while Pymble Ladies’ College (912), Brigidine College, Ravenswood, Roseville College and Barker College concentrate premium independent options within short drives. Primary standouts—St Ives North PS, Wahroonga PS, Pymble PS, Warrawee PS and Gordon West PS—lift day‑to‑day convenience and underpin price tension for in‑zone streets.

Connectivity is equally strong. Gordon Station (1,068 mentions) and Pymble/Turramurra provide frequent city services, with express runs to Wynyard in roughly 25 minutes—a commuting advantage that keeps dual‑income professional households sticky to the area. Retail is village‑scaled rather than mega‑mall: St Ives Shopping Village (1,086) offers more than 110 speciality stores, while Turramurra’s café strip and weekend growers’ market add local texture. Recreation nodes such as St Ives Village Green broaden appeal for sport‑active families. Proximity to Macquarie University (390) and its research precinct diversifies education and employment links without sacrificing the area’s quiet, leafy character.

Micro‑markets span East Killara, East Lindfield, Gordon, Killara, Lindfield, North Turramurra, North Wahroonga, Pymble, Roseville, Roseville Chase, South Turramurra, St Ives, St Ives Chase, Turramurra, Wahroonga, Warrawee and West Pymble. Across these pockets, buyers typically arbitrate between rail‑walkability (Gordon, Pymble, Turramurra, Wahroonga) and larger, bush‑fringe blocks (St Ives, North Turramurra, South Turramurra, St Ives Chase).

Buyer takeaway: Ku‑ring‑gai’s combination of high family share, top‑tier schools, rail efficiency and a high‑ownership tenure mix provides classic blue‑chip defensiveness with genuine liveability. Focus on catchment lines for Killara Highand the premier primaries, walking access to Gordon/Pymble/Turramurra stations, and streets with strong owner‑occupier continuity. For households seeking long‑term settlement rather than speculative turnover, Ku‑ring‑gai sets the benchmark.

Dural–Wisemans Ferry (NSW)

Thirty‑eight kilometres north‑west of the CBD, Dural – Wisemans Ferry (SA3) offers a rare mix of semi‑rural space and metropolitan access within the Sydney – Baulkham Hills and Hawkesbury corridor. The median asking price is $2,650,000 (12 months), anchored by a family household share of 83.0%, an overwhelmingly detached housing stock (90.5%), and a fully‑owned tenure share of 44.0%. Combined with a Family Rating of 5/5 and Socio Economic score of 9 (very high), the data points to a stable, high‑income owner‑occupier base—conditions that typically underpin low volatility and durable long‑run value.

What families rate most is captured in the Suburbtrends Area Hotlist. Lifestyle is led by the Hawkesbury River (556 votes) and the charm of Wisemans Ferry (204)—weekend boating, riverside dining and national‑park bushwalking that double as a daily wellbeing dividend. School quality is a defining driver of demand: Hills Grammar (386), Oakhill College (195), Pacific Hills (132) and Northholm Grammar (98) headline extensive independent choices, complemented by strong public options such as Dural Public (106), Glenhaven Public (93), Samuel Gilbert Public (89) and Galston High (72). These catchments consistently translate into price tension for acreage homes on quiet country lanes.

Employment and connectivity are unusually convenient for a semi‑rural market. Norwest Business Park (99) brings an estimated tens of thousands of high‑salary jobs within a short drive, reducing CBD dependence. The North West Metro at Rouse Hill Town Centre (180) links through to Chatswood in about 35 minutes, while Windsor Station (61) delivers T1 rail to Parramatta and Central at regular frequencies—broadening commuting options for dual‑income households. Day‑to‑day retail is practical rather than mega‑scale: Round Corner Shopping Centre (81) anchors errands with easy parking and local services.

Micro‑markets span Annangrove, Arcadia, Berrilee, Canoelands, Dural, Fiddletown, Galston, Glenorie, Kenthurst, Laughtondale, Leets Vale, Maroota, Middle Dural, Sackville North, South Maroota and Wisemans Ferry. Buyers typically trade off block size, equestrian or hobby‑farm utility and river proximity against Metro or bus access and school bus routes. Acreage belts in Dural, Kenthurst, Glenorie and Galston skew to larger parcels and privacy; river villages from Wisemans Ferry to Leets Vale offer outlooks and weekend amenity that are hard to replicate closer in.

Buyer takeaway: With very high family and ownership shares, dominant detached supply and elite schooling breadth, Dural – Wisemans Ferry delivers blue‑chip defensiveness with genuine lifestyle utility. Prioritise school corridors, Metro/bus connectivity and acreage streets with strong owner‑occupier continuity to secure long‑term liveability and capital resilience.

Bayside (VIC)

Roughly 11 km south‑east of the CBD, Bayside (SA3) spans Beaumaris, Black Rock, Brighton, Brighton East, Hampton, Hampton East, Highett and Sandringham along Port Phillip Bay. The median asking price is $1,875,000 (12 months), supported by a family household share of 72.9%, a detached‑house mix of 62.5%, and 41.3% fully owned dwellings. With a Family Rating of 4/5 and a Socio Economic score of 9 (very high), the data signals a deep owner‑occupier base and strong household incomes—typical foundations for price stability through cycles.

What households value most is captured in the Suburbtrends Area Hotlist. Amenity starts on the sand: Brighton Beach (134 mentions) and Sandringham Beach (91) anchor the coastline, with Hampton Beach (76) adding family‑friendly foreshore. Retail “main streets” rank highly—Church Street Brighton (112), Hampton Street (95) and Bay Street (87)—delivering daily convenience, dining and services without sacrificing a village feel. Bayside’s nautical identity is reinforced by Sandringham Yacht Club (83) and Royal Brighton Yacht Club (79), while the Brighton Baths (66)provide year‑round bay access. Green space is extensive: Elsternwick Park (72), Dendy Park (45) and Thomas Street Park (47) act as community lungs, with Brighton Golf Course (53) offering additional open‑space amenity.

Education breadth is another demand driver. Brighton Grammar (69), Firbank Grammar (50) and Xavier College Brighton (42) headline independent options, complemented by well‑regarded primaries such as Hampton Primary (61). Families routinely prioritise walk‑to‑school streets and safe cycling routes, which in turn supports values for homes proximate to these catchments.

Connectivity is straightforward and highly valued by dual‑income households. Sandringham Station (64 mentions)—the terminus of the Sandringham line—and Brighton Beach Station (58) provide direct rail to the city, dovetailing with the walkable retail strips noted above to support a car‑light daily rhythm.

Micro‑market choices vary by lifestyle emphasis. Brighton/Brighton East concentrate prestige housing close to Church Street and the yacht clubs; Hampton/Highett balance rail access with parks and family‑scale period homes; Beaumaris/Black Rock skew to coastal calm and large reserves near the shoreline; Sandringham blends a relaxed village centre with beaches and the marina. Across these pockets, buyers typically trade off beach proximity, school catchment, and retail‑rail walkability.

Buyer takeaway: Bayside’s combination of coastal amenity, premium schooling, strong owner‑occupier tenure and high socio‑economics underpins a classic blue‑chip profile. For long‑term family settlement, focus on catchment lines, proximity to Church Street/Hampton Street/Bay Street, and walkable access to Sandringham or Brighton Beachstations to maximise liveability and capital resilience.

Burnside (SA)

By User:Orderinchaos - Own work, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=19182571

Around 7 km east of the CBD, Burnside (SA3) sits in the Adelaide – Central and Hills corridor with a family‑first profile and strong ownership signals. The median asking price is $1,630,000 (12 months), supported by 70.7% family households, a detached‑house share of 66.9%, and 42.8% fully owned dwellings. A Family Rating of 5/5 and Socio Economic score of 9 (very high) point to an entrenched, high‑income owner‑occupier base—typically a stabiliser for values through the cycle.

What families rate most is clear in the Suburbtrends Area Hotlist. Daily convenience is anchored by Burnside Village (1,245 votes)—designer retail and fresh food under one roof—while The Parade (465) and Magill Road (392) extend dining and specialty options minutes away. Education breadth is a standout demand driver: Glenunga International High School (612 votes) draws state‑wide interest with the International Baccalaureate; Linden Park Primary (512), Seymour College (431), Norwood International High (202) and St Peter’s Girls (187) add depth across primary and secondary years. Health and wellbeing are well served by Burnside Hospital (146), Burnside Library (257) and the George Bolton Swimming Centre (171).

Lifestyle utility is unusually rich for a near‑city market. Trailheads at Waterfall Gully (478) connect to the Mount Lofty Summit (332), while Hazelwood Park (351) and Kensington Gardens Reserve (298) deliver shaded ovals, nature play and picnic lawns. Mount Osmond Golf Club (138) adds open‑space amenity with sweeping city views. Access to the Adelaide CBD (601 votes) is straightforward via Greenhill and Kensington Roads, reinforcing the area’s appeal to dual‑income households.

Micro‑markets span Auldana, Beaumont, Beulah Park, Burnside, Dulwich, Eastwood, Erindale, Frewville, Glen Osmond, Glenside, Glenunga, Hazelwood Park, Kensington Gardens, Kensington Park, Leabrook, Linden Park, Mount Osmond, Rose Park, Rosslyn Park, Skye, St Georges, Stonyfell, Toorak Gardens, Tusmore, Waterfall Gullyand Wattle Park. Buyers typically trade off foothills seclusion and trail access (Stonyfell, Skye, Waterfall Gully, Mount Osmond) against city‑edge walkability and heritage streets (Toorak Gardens, Rose Park, Dulwich). Proximity to catchments for Glenunga International and Linden Park Primary remains a key price driver.

Buyer takeaway: Burnside combines elite schooling, abundant parklands and short CBD access with high family and ownership shares—classic blue‑chip characteristics. Prioritise school corridors, walkability to Burnside Village or The Parade, and foothills pockets offering both privacy and swift city links to maximise liveability and capital resilience.

Sutherland–Menai–Heathcote (NSW)

About 25 km south of the CBD, Sutherland – Menai – Heathcote (SA3) anchors the Shire’s inland ridge and river valleys with classic family settings and strong amenity. The median asking price is $1,610,000 (12 months), underpinned by a 79.6% family‑household share, a 70.3% detached‑housing mix, and 36.8% fully owned dwellings. A Family Rating of 5/5 and a Socio Economic score of 9 (very high) point to deep owner‑occupier engagement and stable incomes—attributes that typically protect values through the cycle.

What families value most is clear in the Suburbtrends Area Hotlist. Lifestyle utility is exceptional: Royal National Park – Audley (1,062 mentions) and Heathcote National Park (589) deliver trailheads, swimming holes and weekend picnics minutes from home, while the Woronora River (712) and Georges River (451) add kayaking, jetties and sunset lookouts. Structured sport is first‑rate at The Ridge Sports Complex (645) and Barden Ridge Golf & FootGolf (297), complemented by the Engadine Leisure Centre & Pool (396). Day‑to‑day shopping is handled by Menai Marketplace (874) and Illawong Village (232), allowing families to stay local for groceries, cafés and services.

Connectivity suits dual‑income households. The Bangor Bypass Park’n’Ride (312) speeds commuters to Sutherland Station, while Engadine Town Centre (132) provides express trains reaching Central in about 45 minutes. Recent upgrades along the New Illawarra Road commuter link (149) have trimmed peak travel times and improved cycling shoulders. Weekend movement is just as easy via Woronora Bridge Lookout & Boat Ramp (363) and Sandy Point Reserve (118), keeping river access front‑of‑mind for active families.

Economic depth adds resilience. The ANSTO Discovery Centre (482) highlights a concentration of high‑skilled jobs at Lucas Heights, while tourism‑heritage assets like the Loftus Tramway Museum (171) strengthen local identity and visitor flows.

Micro‑market choices span river, ridge and rail. Woronora, Oyster Bay and Como trade on water outlooks and trail access; Illawong and Alfords Point offer peninsula privacy with village convenience; Menai, Bangor and Barden Ridge skew to larger family homes near sports infrastructure; Engadine, Heathcote, Jannali, Kirrawee and Sutherlandbalance rail walkability with bush‑edge parks; Loftus, Woronora Heights, Yarrawarrah and Waterfall appeal to buyers prioritising national‑park proximity.

Buyer takeaway: With very high family share, dominant detached supply and strong socio‑economics, Sutherland – Menai – Heathcote delivers blue‑chip defensiveness wrapped in everyday liveability. Prioritise corridors offering rail or Park’n’Ride access, proximity to river or national‑park amenity, and streets with clear owner‑occupier continuity to secure long‑term lifestyle and capital resilience.

Manningham–East (VIC)

By Bob Tan - Own work, CC BY 4.0, https://commons.wikimedia.org/w/index.php?curid=138038786

Roughly 22 km east of the CBD, Manningham – East (SA3) spans Donvale, Park Orchards, Warrandyte, Warrandyte South and Wonga Park, offering semi‑rural calm with metropolitan access. The median asking price is $1,565,000 (12 months), underpinned by an exceptionally high family‑household share of 83.0%, a dominant detached‑house mix of 93.3%, and 44.9% fully owned dwellings. With a Family Rating of 5/5 and a Socio Economic score of 9.25 (very high), the area presents a deep owner‑occupier base—conditions that typically support lower volatility and durable long‑run value.

Amenity is both practical and lifestyle‑rich. The Pines Shopping Centre (612 mentions) anchors day‑to‑day convenience, while Tunstall Square (491) delivers a locals‑first village for groceries, dumplings and Saturday produce markets. Major retail and entertainment scale sits close by at Westfield Doncaster (139). For active families, the green wedge is the signature: Ruffey Lake Park (433), Mullum Mullum Creek Trail (387), Warrandyte State Park (352), Currawong Bush Park (308), The 100 Acres Reserve (176) and the Yarra River Parklands (131) provide trails, paddling, nature play and picnic lawns—amenities that translate directly into price tension for streets bordering bushland and open space.

Education breadth is a clear demand driver. Independent options—Yarra Valley Grammar (271), Whitefriars College (259), Luther College (244) and Donvale Christian College (154)—sit alongside high‑performing public schools such as Doncaster East Secondary College (233) and Serpell Primary (217), plus Andersons Creek Primary (146) near the Warrandyte village. Catchment certainty and dedicated bus networks sustain premium willingness‑to‑pay and keep family rentals tight.

Connectivity is straightforward for dual‑income households. EastLink (548) and the Eastern Freeway (201) place the CBD at around 25 minutes off‑peak, with future North East Link upgrades flagged within the corridor, while weekend trips to the Mornington Peninsula or airport are materially faster via the M3. Fitness and aquatic needs are met at Aquarena (192).

Micro‑markets reflect different lifestyle trade‑offs. Donvale balances freeway access with schools and village convenience; Park Orchards offers quarter‑acre blocks and community sport at Domeney Reserve (161); Warrandyte and Warrandyte South deliver river‑village character and heritage pockets near Andersons Creek; Wonga Park skews to acreage and privacy. Buyers typically arbitrate between block size, bush adjacency and motorway access.

Buyer takeaway: With very high family and ownership shares, overwhelming detached supply and elite schooling, Manningham – East offers classic blue‑chip defensiveness wrapped in genuine lifestyle utility. Target school corridors, streets abutting parkland or trails, and locations with swift EastLink/Eastern access to optimise liveability and capital resilience.

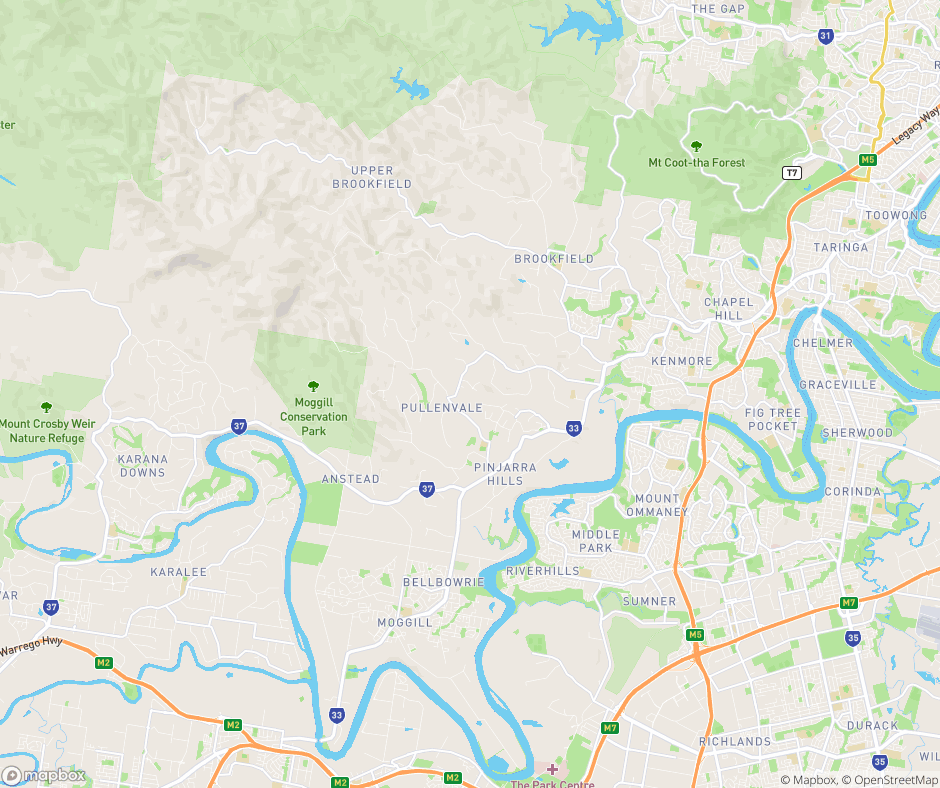

Kenmore–Brookfield–Moggill (QLD)

Around 8 km from the CBD, Kenmore – Brookfield – Moggill (SA3) blends near‑city access with a green‑belt lifestyle. The median asking price is $1,456,000 (12 months), supported by an exceptionally high family‑household share (84.7%), a dominant detached‑housing mix (95.2%), and 38.1% fully owned dwellings. A Family Rating of 5/5 and a Socio Economic score of 9.75 (very high) indicate a deep, high‑income owner‑occupier base—conditions that typically deliver low turnover, contained volatility and strong long‑run value preservation.

What families rate most shows in the Suburbtrends Area Hotlist. Day‑to‑day convenience is anchored by Kenmore Village and Kenmore Plaza, with Moggill Village adding a new full‑line supermarket hub for the western peninsulas. For larger‑format retail and entertainment, Indooroopilly Shopping Centre sits within an easy drive. Education breadth is a defining demand driver: government standouts such as Kenmore State High School, Indooroopilly State High (IB), Kenmore South SS, Chapel Hill SS, Moggill SS and Fig Tree Pocket SS combine with independent depth across St Peters Lutheran College, Brisbane Boys’ College, Brigidine College, Ambrose Treacy College and Brisbane Montessori School. Specialist provision at Mancel College further broadens options, helping keep family rentals tight around key bus routes.

Lifestyle utility is unusually rich for a near‑city market. Mt Coot‑tha delivers lookouts, trails and the Botanic Gardens, while the Brisbane River frames kayaking, rowing and leafy riverfront streets in Fig Tree Pocket. Sports clubs, swim schools and pocket parks are woven through Kenmore and Chapel Hill, reinforcing a child‑friendly rhythm without sacrificing access to city jobs.

Connectivity suits dual‑income households. City‑bound bus corridors along Moggill Road link to rail at Indooroopilly, while the Western Freeway places the CBD and inner‑south employment nodes within practical commuting range. This transport profile, coupled with short trips to major schools and centres, underpins willingness‑to‑pay for well‑located family homes.

Micro‑markets span Anstead, Bellbowrie, Brookfield, Chapel Hill, Fig Tree Pocket, Kenmore, Kenmore Hills, Moggill, Pinjarra Hills, Pullenvale and Upper Brookfield. Buyers typically arbitrate between acreage privacy and bush adjacency (Brookfield, Upper Brookfield, Pullenvale, Anstead), village convenience near retail and schools (Kenmore, Chapel Hill), new‑centre practicality (Moggill, Bellbowrie), and river‑precinct amenity (Fig Tree Pocket).

Buyer takeaway: With very high family and ownership shares, overwhelmingly detached stock, elite schooling and robust socio‑economics, Kenmore – Brookfield – Moggill offers classic blue‑chip defensiveness wrapped in everyday liveability. Prioritise streets offering walkable access to Kenmore Village/Plaza or Moggill Village, proximity to key school corridors (especially Kenmore SHS and Indooroopilly SHS), and blocks that capture either river outlooks or green‑belt seclusion for long‑term lifestyle and capital resilience.

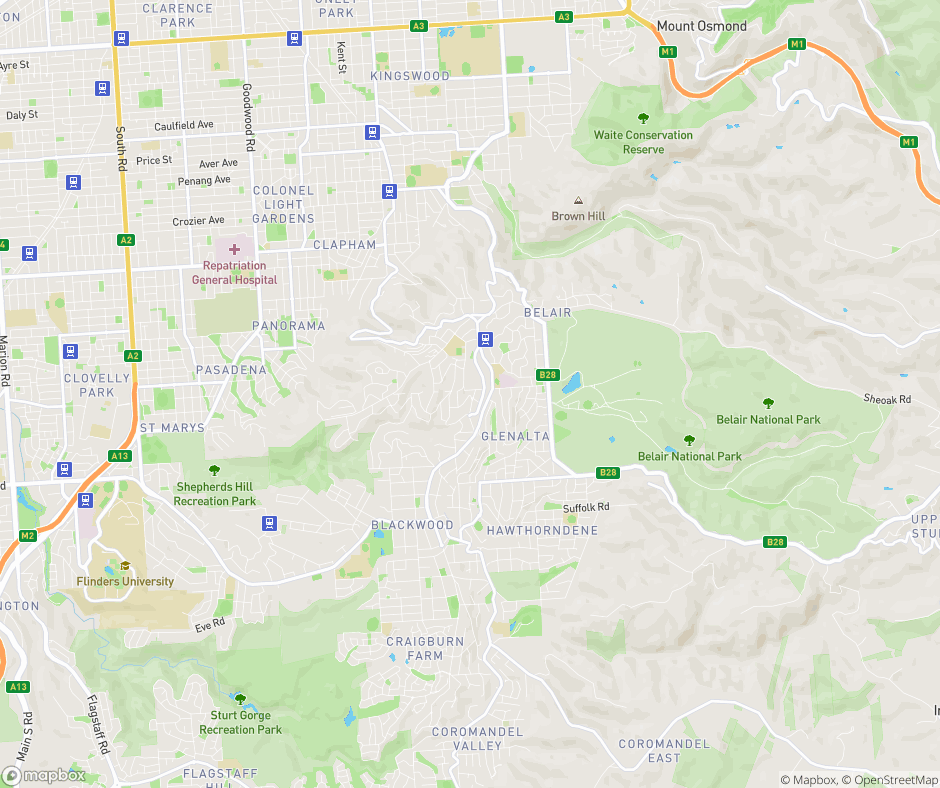

Mitcham (SA)

Roughly 7 kilometres south of the CBD, Mitcham (SA3) sits in the Adelaide – South corridor with classic family credentials and strong ownership signals. The median asking price is $1,200,000 (12 months), supported by 73.3% family households, a detached‑house share of 78.6%, and 38.4% fully owned dwellings. A Family Rating of 5/5 and Socio Economic score of 8.75 (high) point to a deep owner‑occupier base—typically a stabiliser for values and a sign of long‑run durability through cycles.

Amenity is both practical and lifestyle‑rich. Mitcham Square Shopping Centre (872 votes) anchors daily convenience with fresh food, cafés and cinemas, while Pasadena Central (689) turns the weekly shop into a gourmet outing. Parklands frame the area’s identity: Belair National Park (795), Brownhill Creek Recreation Park (553) and Shepherds Hill Recreation Park (421) deliver trails, ovals and nature play minutes from home; Waite Arboretum (322)adds botanical calm, and Mount Lofty Summit (273) offers panoramic weekend resets. Commuting is straightforward via Belair Road (447), and Blackwood Railway Station (463) combines heritage charm with park‑and‑ride and peak services every 15 minutes, reinforcing a car‑light rhythm for city workers.

Education breadth is a defining demand driver. Public standouts—Mitcham Girls High School (612), Blackwood High (522), Colonel Light Gardens Primary (357) and Unley High (296)—sit alongside elite independents: Scotch College (741) on the Torrens Park estate, Mercedes College (398) at Springfield, and St John’s Grammar (497) amid Belair’s stringybarks. Catchment certainty and short travel times keep four‑bedroom family homes in hot demand, particularly near school corridors and safe cycling routes. Civic assets including Mitcham Memorial Library (344) complement the learning ecosystem with maker spaces and study pods.

Micro‑market choices span Bedford Park, Belair, Bellevue Heights, Blackwood, Clapham, Clarence Gardens, Colonel Light Gardens, Craigburn Farm, Cumberland Park, Daw Park, Eden Hills, Glenalta, Hawthorn, Hawthorndene, Kingswood, Leawood Gardens, Lower Mitcham, Lynton, Melrose Park, Mitcham, Netherby, Panorama, Pasadena, Springfield, St Marys, Torrens Park, Urrbrae and Westbourne Park. Buyers typically arbitrate between hills seclusion and national‑park adjacency (Belair, Glenalta, Craigburn Farm, Hawthorndene), heritage garden‑suburb character (Colonel Light Gardens, Kingswood, Hawthorn), and city‑edge convenience near Belair Road and rail (Lower Mitcham, Torrens Park, Blackwood).

Buyer takeaway: With high family and ownership shares, dominant detached supply and elite schooling, Mitcham delivers blue‑chip defensiveness with everyday liveability. Prioritise streets within catchments for Mitcham Girls Highand the premier primaries, proximity to Scotch/Mercedes/St John’s corridors, walkable access to Mitcham Square or Blackwood Station, and pockets abutting Belair or Brownhill Creek to maximise lifestyle yield and capital resilience.

Nillumbik–Kinglake (VIC)

Roughly 20 km north‑east of the CBD, Nillumbik – Kinglake (SA3) offers a distinctive bush‑meets‑metro proposition. The median asking price is $1,150,000 (12 months), supported by a very high family‑household share (83.8%), an overwhelmingly detached‑housing mix (93.8%), and 40.6% fully owned dwellings. With a Family Rating of 4/5 and Socio Economic score of 9 (very high), the tenure and income mix points to a deep owner‑occupier base—conditions that typically deliver contained volatility and durable long‑run value.

Households value both convenience and nature, as the Suburbtrends Area Hotlist shows. Eltham Village (363 mentions)anchors daily life with supermarkets, cafés and live‑music evenings beside the trestle bridge, while regional scale sits close by at Greensborough Plaza (152). Rail connectivity is a genuine asset: Eltham Station (68) runs Metro services roughly every 20 minutes at peak to Flinders Street in under 45 minutes, with Diamond Creek Station (24) benefiting from a passing‑loop upgrade and Hurstbridge Station (11) tying the line together. Education breadth is a key demand driver—Eltham College (172) and St Helena Secondary College (146) headline the schooling offer, complemented by Research Primary (49) and a network of quality primaries.

Amenity skews strongly to open‑space utility, underpinning a lifestyle premium for green‑edge streets. Diamond Creek Trail (132) links joggers and cyclists through shady river gums; Warrandyte State Park (54) and Kinglake National Park (38) deliver river beaches, tall‑forest hikes and mountain‑bike loops; family staples such as Eltham North Adventure Playground (43) and Edendale Community Farm (29) reinforce child‑friendly credentials. Eltham Leisure Centre (27) and Yarrambat Golf Course (6) broaden the health‑and‑sport footprint.

Micro‑markets are diverse across Arthurs Creek, Bend of Islands, Castella, Christmas Hills, Cottles Bridge, Diamond Creek, Eltham, Hurstbridge, Kangaroo Ground, Kinglake, Kinglake Central, Kinglake West, North Warrandyte, Nutfield, Panton Hill, Pheasant Creek, Plenty, Research, Smiths Gully, St Andrews, Strathewen, Toolangi, Wattle Glen and Yarrambat. Buyers typically arbitrate between rail‑walkability and village life (Eltham, Diamond Creek, Wattle Glen, Hurstbridge), river‑bush seclusion (North Warrandyte, Bend of Islands), acreage privacy (Yarrambat, Kangaroo Ground, Panton Hill, Smiths Gully) and cool‑climate ridge living (Kinglake, Toolangi, St Andrews).

Buyer takeaway: With very high family share, dominant detached supply and strong socio‑economics, Nillumbik – Kinglake delivers blue‑chip defensiveness with everyday liveability. Focus on school corridors (St Helena zone, Eltham College access), walkable links to Eltham/Diamond Creek rail and village centres, and streets abutting trails or parklands to maximise lifestyle yield and long‑term capital resilience.

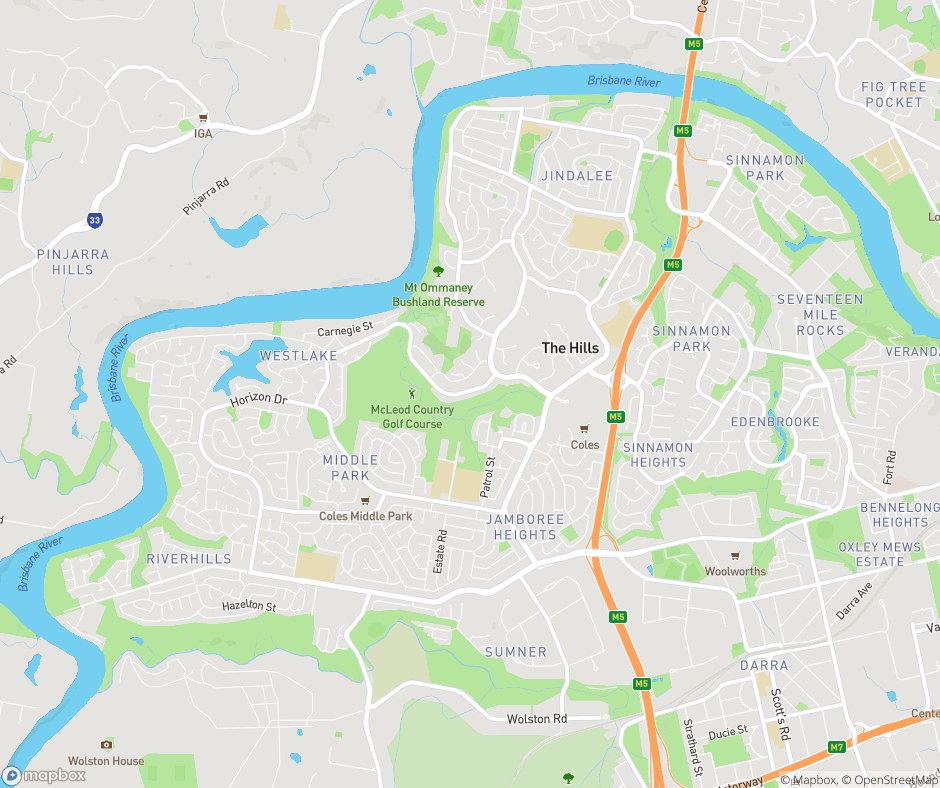

Centenary (QLD)

Roughly 11 km west of the CBD, Centenary (SA3) spans Jamboree Heights, Jindalee, Middle Park, Mount Ommaney, Riverhills, Seventeen Mile Rocks, Sinnamon Park and Westlake. The median asking price is $1,100,000 (12 months), supported by a very high family‑household share (82.1%), an overwhelmingly detached‑housing mix (91.4%), and 36.5% fully owned dwellings. With a Family Rating of 4/5 and a Socio Economic score of 8.5 (high), Centenary presents a deep owner‑occupier base and strong household incomes—conditions that typically dampen volatility and support durable long‑run value.

Amenity is anchored by retail depth and schooling. Mount Ommaney Centre (233 mentions) delivers majors and 170+ specialty stores, while DFO Jindalee (151) adds a weekend drawcard for fashion and dining. Family‑friendly staples such as Rocks Riverside Park (81) and Seventeen Mile Rocks Park (7) provide mega‑playgrounds, BMX and shaded picnic lawns; water access via the Jindalee Boat Ramp (84) lifts the appeal of river‑adjacent streets. Golf and recreation breadth is notable for a middle‑ring market, with McLeod Country Golf Club (127) and Jindalee Golf Club (63)catering to both serious and social players.

Education is a clear demand driver. Centenary State High School (255)—with STEM depth and rowing on the Brisbane River—anchors secondary appeal, while Jamboree Heights SS (214) and Good News Lutheran (193) underpin primary choice. Wider options are close at hand: Indooroopilly State High (IB), University of Queensland, and major private schools along the western corridor broaden pathways and help keep family rentals tight around key bus routes.

Connectivity suits dual‑income households. The Centenary Highway (137 mentions) and Western Freeway (43) link quickly to the CBD, hospitals and universities; express buses put the city within about 40 minutes, while Oxley Station (15) offers ~24‑minute rail to Central. This transport profile, combined with short trips to Indooroopilly Shopping Centre (38), underpins a practical, car‑light daily rhythm.

Micro‑markets vary by lifestyle trade‑off. Mount Ommaney and Westlake appeal for golf and river proximity; Jindalee and Jamboree Heights balance schools with retail and the boat ramp; Middle Park and Riverhills skew to quiet family streets near parklands; Sinnamon Park and Seventeen Mile Rocks capture riverside recreation and quick freeway access.

Buyer takeaway: With very high family share, dominant detached stock and strong socio‑economics, Centenary offers classic blue‑chip defensiveness and everyday liveability. Focus on catchments for Centenary SHS and Jamboree Heights SS, walkable access to Mount Ommaney Centre/DFO Jindalee, and corridors near the Centenary Hwy/Western Fwy or Oxley Station to optimise lifestyle yield and long‑term capital resilience.